Checking

With a BFCU share draft account, there are no confusing relationships or tricky fees…just simple, unlimited 24/7 access to your money with no strings attached. A share draft account is loaded with time- and money-saving features:

With a BFCU share draft account, there are no confusing relationships or tricky fees…just simple, unlimited 24/7 access to your money with no strings attached. A share draft account is loaded with time- and money-saving features:

- No minimum to open

- No minimum daily balance requirements

- No monthly service fees

- No per-check fees

- Online check reorder

- Overdraft protection

- Free Debit Mastercard

- Free 24/7 online/ATM access

- Free online bill pay with picture pay

- Free check copies in digital banking

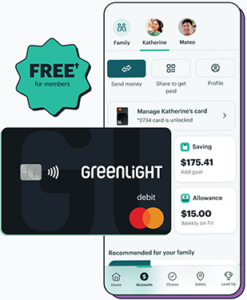

- Greenlight, the money app and debit card for kids and teens—free!*

For your protection, order your drafts (checks) through Bulldog instead of outside printers so you can be sure they’re printed with accurate account and routing numbers. Bulldog drafts through Harland Clarke come in a wide variety of styles and offer industry-leading security features designed to protect your account.

Browse catalog & Reorder drafts (new window/tab)

Need a check copy? View and print cleared checks for free right from digital banking (for checks cleared after 3/1/21). For check copies prior to 3/1/21, please contact the Credit Union.

If you don’t have access to an overdraft line of credit, we will automatically transfer funds from your share account to cover overdrafts for a nominal fee. You must have an available balance in your share account to cover the transfer.

Let us show you how easy it is to move your checking account to Bulldog!

*Bulldog Federal Credit Union members are eligible for the Greenlight SELECT plan at no cost when they connect their BFCU account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Upon termination of promotion, members will be responsible for associated monthly fees. See terms for details. Offer ends 11/05/2026. Offer subject to change or renewal. The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International.

Greenlight

Enjoy Greenlight’s money app and debit card for free†.

Join 6+ million parents and kids learning to earn, save, and spend wisely — together.

A debit card for kids. And so much more.

● Money management

Send money instantly, set flexible controls, and get real-time notifications.

● Chores and allowance

Assign chores and automate allowance — with the option to connect payouts to chore progress.

● Savings goals

Set savings goals for what your kids really want — and watch them grow together.

● Financial literacy game

Kids play Greenlight Level Up™, the game that makes money concepts easy to understand and fun to learn.

Get your free† Greenlight subscription today.

The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International.

†Bulldog Federal Credit Union members are eligible for the Greenlight SELECT plan at no cost when they connect their BFCU account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Upon termination of promotion, members will be responsible for associated monthly fees. See terms for details. Offer ends 11/05/2026. Offer subject to change or renewal. Card images shown are illustrative and may vary from the card you receive.

Check Reorder

If you’ve ordered checks from BFCU before, then reordering online is fast and easy! Have the Order Identification Number from your check reorder form handy when reordering checks online.

If you’ve ordered checks from BFCU before, then reordering online is fast and easy! Have the Order Identification Number from your check reorder form handy when reordering checks online.

Browse catalog & Reorder drafts (new window/tab)

Initial order must be placed in person at a branch. Online reorders cannot be processed if your address does not match the address we have on file for you. Your share draft account number is not the same as your member account/ID number. If you do not know your share draft account number, contact the credit union.